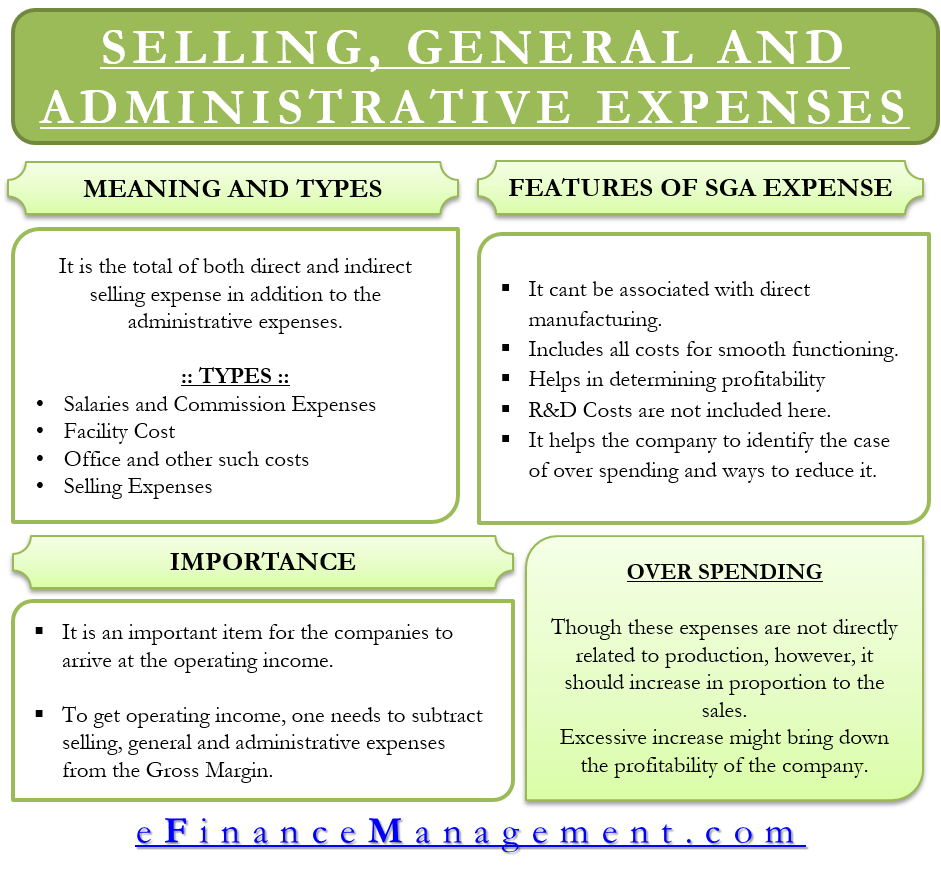

Selling costs include the salaries and commissions of salespeople, advertising expenses, and shipping expenses. If you accidentally include SG&A costs in the calculation of gross profit, some of the product lines will seem to have done better or worse than they actually did. Gross profit is revenue minus manufacturing costs such as materials, labour, and some allocated overhead. To figure this out, it’s important to distinguish which of the costs are SG&A. The root of this answer is to calculate the gross profit per product. These types of costs are generally unavoidable and related to supporting the development and sale of your clients’ goods.Īs your client makes different product lines, they want to know which products are doing well and which are struggling. These additional expenses are called selling, general, and administrative (SG&A) costs and are reported on the profit and loss statement. They also have certain expenses, such as rent and utilities, that are necessary but not directly tied to what they make. They may be integrated with selling expenses (in which case the cluster of expenses is known as selling, general and administrative expenses), or they may be stated separately.Some of your clients’ costs are specifically related to making their products. General and administrative expenses appear in the income statement immediately below the cost of goods sold. Presentation of General and Administrative Expense Consequently, switching away from a command-and-control system can reduce these expenses. Instead, all expenses must be justified before they will be allowed into the next year’s budget.Ī company that has a strong, centralized command-and-control management system in place is likely to spend much more on general and administrative expenses than a business that has a decentralized organizational structure, and which therefore does not require extra staff to control the activities of subsidiaries. One control technique is zero-base budgeting, where budgets are not automatically rolled forward from the prior year. However, many of these expenses are fixed in nature, and so can be fairly difficult to eliminate in the short term. There tends to be strong cost-reduction pressure on general and administrative expenses, since these costs do not directly contribute to sales, and so only have a negative impact on profits.

#Selling general and administrative expenses how to#

How to Control General and Administrative Expenses General and administrative expense is generally not considered to include research and development (or engineering) expenses, which are usually aggregated into a separate department.

There are many types of general and administrative expenses, including the following:Ĭorporate management wages and benefits (such as for the chief executive officer and support staff)

Examples of General and Administrative Expenses This information is needed to determine the fixed cost structure of a business. Another way of describing general and administrative expenses is any expense that will still be incurred, even in the absence of any sales or selling activity. These expenses are not related to the construction or sale of goods or services. General and administrative expense is those expenditures required to administer a business.

0 kommentar(er)

0 kommentar(er)